THE NEXT BIG THING

BUSINESS DEVELOPMENT KA

BIG BOSS

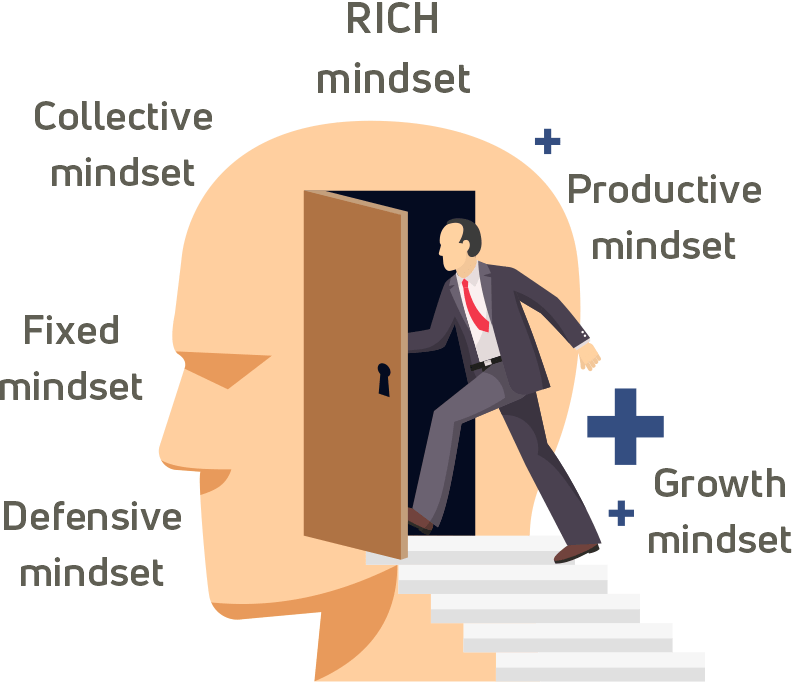

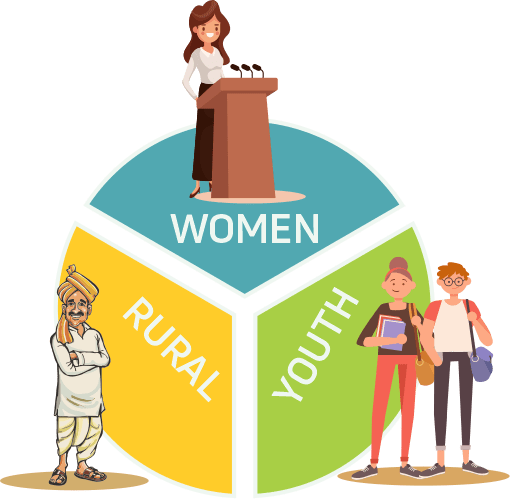

Become the ‘Wizard of Business’ with The Next Big Thing – an online business development module initiated with the sole purpose of educating & motivating financial entrepreneurs and individuals who aspire to invest and earn.