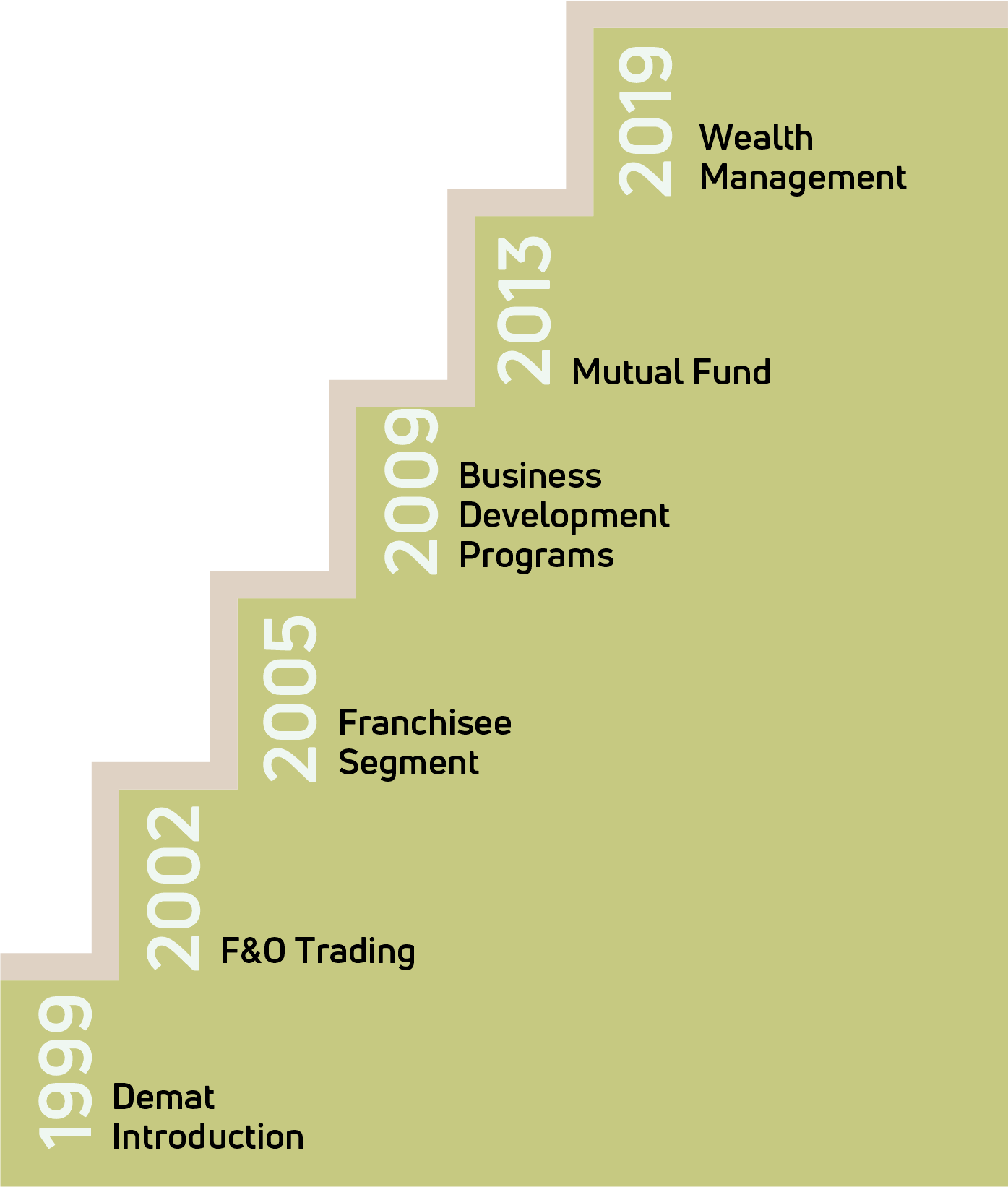

A prominent financial expert, a popular personal finance mentor, he is India’s leading voice in financial training, investing and building wealth. His trailblazer programs and courses help investors, intermediaries, individuals and businesses, set the right goals and navigate their financial success

Renowned for his ability to transform the most difficult financial concepts into easy-to-understand analogies, Hitesh Mali has transformed financial training from tedious to fun, from preachy to practicable and from drab to fab. Across 24 years as a strategic business consultant, he has helped aspirers bust financial myths,

overcome limiting beliefs and achieve greater success. His strategy based motivational training programs and entrepreneurial courses also include comprehensive business planning, investment panning, business roadmap creation and business development support.